- Marketplace⚡Mastery

- Posts

- Marketplace⚡Mastery #124: free Walmart 1P recovery audit, Amazon opts you into AI selling + Google launches agentic commerce

Marketplace⚡Mastery #124: free Walmart 1P recovery audit, Amazon opts you into AI selling + Google launches agentic commerce

Hey sellers! Amazon quietly opts brands into AI selling, Google fires back with agentic commerce, and Walmart sellers might be sitting on recoverable cash.

🛑 Attention Amazon Sellers

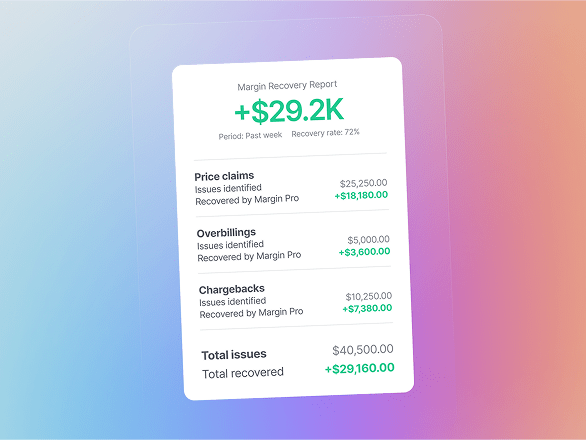

Walmart US Vendors we are offering FREE Walmart 1P Recovery Audit to identify and recover money lost in deductions:

Pricing deductions

Freight and shortage claims

Returns and damage disputes

Compliance fines

And more

No cost. No obligation.

Let me know if you’re interested replying to this very email.

📰 What you need to know

According to SensorTower’s report, Rufus usage data shows a clear winner: Search Assistant is the dominant behavior, representing roughly 28% of all sessions. This is where Rufus shines most, stepping in when classic Amazon search fails to surface the right product.

These sessions convert hard, with ~35% conversion, long engagement (~63 minutes per session), multiple interactions, and deep product exploration. In short: Rufus is becoming the fix when discovery breaks.

Beyond that, Product Validator sessions (~16%) also perform strongly, helping shoppers compare options and confirm decisions, while Quick Checker sessions (~11%) act as fast confidence checks with lower conversion but high intent. Smaller segments like Casual Searchers, Moderate Researchers, and Browse & Ask users show solid mid-20% conversion rates, proving Rufus is effective at refining vague intent and guiding undecided shoppers. Even Light Browsers, while low converting today, help seed future purchase intent.

👉 Amazon breaks a decade-long Black Friday tradition. For the first time since at least 2016, Amazon did not publish its usual post–Black Friday and Cyber Monday sales recap. More than a month later, there’s still no celebratory post, which is highly unusual for Amazon’s biggest shopping moment of the year.

👉 You won’t believe your eyes, bidding for prompts is finally showing some data!

👉 Are you an Amazon Vendor and speak Spanish? This might be exactly what you need.

The Vendor Guerrilla Challenge is an advanced, 5-day intensive training for brands working with Amazon Vendor who need more control, better margins, and a realistic strategy for 2026.

No corporate slides. No fluff.

Just real-world Vendor strategy, hybrid PPC (Vendor + Seller), P&L analysis, negotiations with Amazon, and profitability frameworks you can actually apply.

👉 Live sessions · Daily Q&A · Practical templates & tools

💡 Designed for experienced Vendors who want clarity and results

🗣️ Training delivered in Spanish by myself and 3 more experts

If Amazon Vendor feels increasingly opaque and unprofitable, this is your wake-up call.

👉 Brands discover their products listed on Amazon via “Buy For Me” without permission. Remember what we discussed last week?

Amazon’s Project Starfish is allegedly creating unauthorized listings for small brands. Turns out Starfish is creating AI-powered listings inside the Amazon Shopping app without the brand’s consent and with no clear opt-out

Orders were routed through their own Shopify stores, effectively turning brands into involuntary drop shippers, with issues ranging from wrong images to out-of-stock items being sold.

👉 Amazon builds massive retail supercenters to challenge Walmart by rolling out a 228,000-square-foot physical retail concept combining groceries, general merchandise, prepared food and on-site fulfillment. The format rivals Walmart Supercenters and turns physical stores into last-mile logistics hubs.

👉 Amazon expands Dash Carts to more Whole Foods locations set to roll out more than 25 Whole Foods stores by the end of 2026. New features include real-time spend and savings tracking, lighter design, higher capacity, more payment options, store maps, and Alexa shopping list integration.

👉 Google launches the Universal Commerce Protocol and Amazon… is missing. The open standard that allows AI agents like Gemini to handle product discovery and checkout. Shopify, Walmart, Target, Etsy and Wayfair are on board. Amazon is notably absent. Why? You should ask? Well, you don’t want to give away your major asset’s (customers) data, especially to a direct competitor.

👉 Amazon’s February variation review split could crush conversions when affected child ASINs start at zero reviews. That leads to lower conversion rates, weaker organic ranking, higher PPC dependency and fast market share loss. Sellers typically get around 30 days’ notice by category, which is often not enough time to recover.

Like this newsletter? Forward it to a friend or recommend us on LinkedIn

💡 Weekly tip: Rufus is using reviews and Q&A to recommend or reject products

Optimize listings for Rufus, not just keywords

Amazon SEO is no longer about stuffing keywords. Rufus and COSMO interpret intent, context, and relationships. Structure your listings so AI can understand them:

Write titles and bullets in natural language that clearly explain use cases, audience, and scenarios.

Use bullets built around intent and noun phrases, not keyword repetition.

Make sure images clearly show attributes like size, color, usage, and context.

Encourage reviews that mention specific use cases, because Rufus summarizes and relies heavily on review content.

SEO today is about being understandable to machines, not just visible to humans.

Extracted from my ebook Amazon SEO in 2025

⚒ Software & services

As we do every week, here are two guides I wrote that actually move the needle on money recovery:

Amazon Vendor Recovery Audit (1P): how to find and win back the revenue you’re missing

Walmart 1P Recovery: what is it and why it’s different from Amazon 1P

Reply